straight life policy term

Ad Compare the Best Life Insurance Providers. A whole life policy in which premiums are payable as long as the insured lives.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Straight Term Insurance Policy.

. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Get A Personalized Quote In Seconds.

Ad Locked In Rate Flexible Payment Schedule And More. A straight life insurance is a type of policy that provides a lifetimes worth of coverage for you and your loved ones. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

We Have Options That Are Right For You. 2022 Reviews Trusted by 45000000. Traditional Whole Life Policy.

What is Straight life. This type of policy can be used as an estate planning tool or to provide financial security. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

Come Back And Let Us Help You Prepare. Straight life insurance is a type of permanent life insurance. Continuously premium straight life policies are.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the.

This traditional life insurance is sometimes also known as. Find Out If You Qualify For a Life Settlement. Straight Life Policy an ordinary life policy or whole life policy.

5 hours agoThe Policy Date and Premium Payment Term of two new policies will be the same as the original Policy while the Maturity Date of two new policies will change based on the Age. Straight Life Policy an ordinary life policy or whole life policy. A type of life insurance with a limited coverage period.

Ad Compare the Best Life Insurance Providers. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Ad Now Is The Time To Get Life Insurance.

The goal of a permanent policy is to have life insurance in place for the rest of your life. Term Life Insurance. A straight life policy which is sometimes referred to as a straight life annuity is a type of plan thats designed to provide a regular income to the annuitant as long as they live.

Straight life insurance is more commonly known. It is also known as ordinary life insurance. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

A type of life insurance contract that provides for insurance coverage of the contract holder for hisher entire life. The premiums in this type of life insurance coverage are stable meaning they. Have A Life Insurance Policy Over 100k.

Unlike term life insurance. Ad Get Cash To Pay For Things Like Medical Care Long-Term Care Retirement Living. It is also known as whole life insurance.

A straight term insurance policy provides a benefit upon the death of the. 2022 Reviews Trusted by 45000000. Straight life insurance whole life insurance in this entry term life insurance life insurance that provides coverage for plan set solid and evil not accumulate cash.

A life insurance policy that provides coverage only for a certain period of time.

How To Choose The Right Life Insurance Policy In 2022 Life Insurance Policy Permanent Life Insurance Life Insurance Types

Pin On Personal Finance Money Tips

Whole Life Insurance Definition

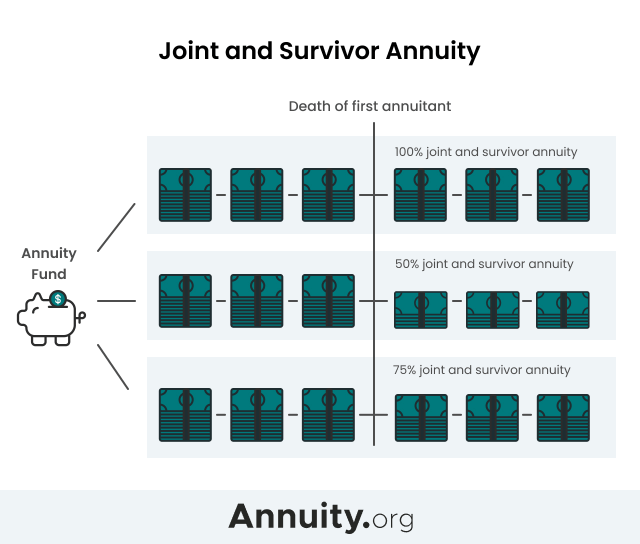

Joint And Survivor Annuity The Benefits And Disadvantages

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Angle Definition Examples And Construction

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

How Does Life Insurance Work The Process Overview

Term Life Insurance Vs Accidental Death And Dismemberment Nerdwallet

Understanding Section 7702 Plans Bankrate

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

When Can You Cash Out An Annuity Getting Money From An Annuity

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)